News

Bonterra Intersects 79.9 g/t Au over 2.1 m; Including 333.0 g/t over 0.5 m at the Barry Underground Project and Provides Corporate Updates

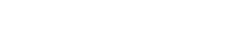

Val-d’Or, QC – November 15, 2022 – Bonterra Resources Inc. (TSX-V: BTR, OTCQX: BONXF, FSE: 9BR2) (“Bonterra” or the “Company”) is pleased to announce the first results from the ongoing infill drilling campaign at the Barry underground project as well as the latest results of the open pit project, which are expected to be used for the grade interpolation of the mineralization at depth. The Company commenced a 125,000 metres (“m”) drill program at the Barry underground deposit last August, which contains 0.5 million ounces of Measured and Indicated Mineral resources and 0.7 million ounces of Inferred Mineral resources, as stated in the last mineral resource estimate (the “2021 MRE”, see press release dated June 23, 2021). To date, 15,900 m (33 holes) of infill drilling has been completed from the surface, mainly in the upper half of the Barry underground deposit.

Highlights include:

- 79.9 g/t Au over 2.1 m, including 333.0 g/t Au over 0.5 m in hole MB-22-529A

- 12.8 g/t Au over 7.9 m, including 29.1 g/t Au over 2.8 m in hole MB-22-433

- 10.7 g/t Au over 5.7 m, including 96.5 g/t Au over 0.5 m and 8.7 g/t Au over 0.5 m in hole MB-22-509A

- 10.2 g/t Au over 4.0 m, including 13.9 g/t Au over 1.1 m and 48.6 g/t Au over 0.5 m in hole MB-22-430

- 12.9 g/t Au over 3.3 m, including 31.3 g/t Au over 1.1 m in hole MB-22-539A

Marc André Pelletier, President and CEO commented: “We are pleased with the recent results of the ongoing infill drilling campaign for the underground deposit at Barry. MB-22-529A drill hole results of 333.0 g/t over 0.5 m represents the highest reported interception ever at the Barry project. This campaign fits well with our strategy of moving the Barry asset toward a production re-start. Considering the magnitude of the underground mineral resources, the deposit has the potential to become a long-lived operation and the Company intends to further define its potential. Drilling at Barry will continue with two drill rigs on site. Also, the pre-feasibility study (“PFS”) on the Barry open pit project is at an important juncture and an update is expected before year end.”

Diamond Drilling Results Highlights:

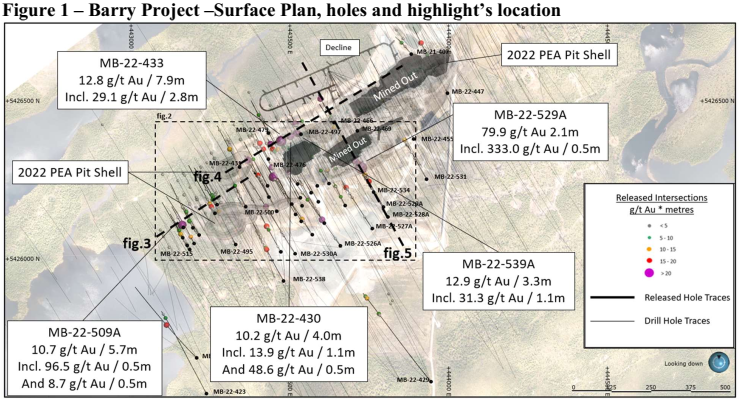

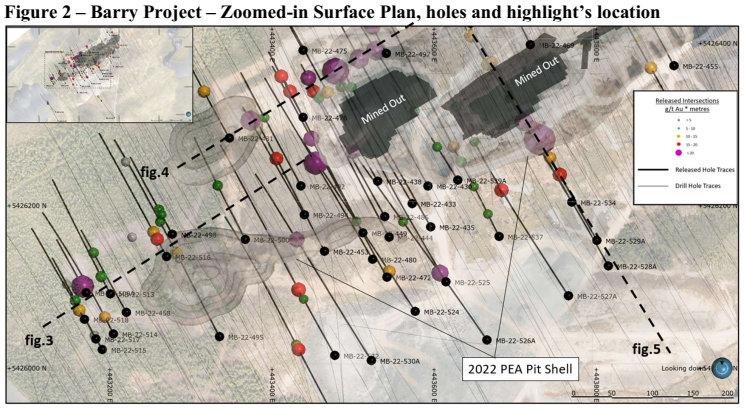

The Barry open pit drill program was designed to fill gaps in the drill spacing in and immediately around the pit shell from the 2021 MRE. Some holes have been extended below the pit scope to target high potential underground mineralization zones and will be used for the grade interpolation of the mineralization at depth. The results obtained from the in the pit mineralization depth range confirmed the strong southeast extension potential yielded by the H6 zone. Highlights include, from 25 to 40 m vertical depth, 10.7 g/t Au over 5.7 m including 96.5 g/t Au over 0.5 m and 8.7 g/t Au over 0.5 m in hole MB-22-509A, 1.5 g/t Au over 8.8 m in hole MB-22-518 and 5.4 g/t Au over 2.8 m including 23.7 g/t Au over 0.6 m in hole MB-22-516 (figure 3).

The definition drilling program of the Barry underground project is designed to convert inferred resources from the 2021 MRE in indicated resources by decreasing the drill spacing to 25 m. The program especially aims to delineate and expand high grades mineralization shoots identified in the 2021 MRE. The results from the H1 zone, 200m below the surface, demonstrated the continuity of these mineralized shoots over more than 150 m. Best results includes : 12.8 g/t Au over 7.9 m including 29.1 g/t Au over 2.8 m in hole MB-22-433, 10.2 g/t Au over 4,0 m including 13.9 g/t Au over 1.1 m and 48.6 g/t Au over 0.5 m in hole MB-22-430 and 12.9 g/t Au over 3.3 m including 31.3 g/t Au over 1.1 m in hole MB-22-539A (figure 4).

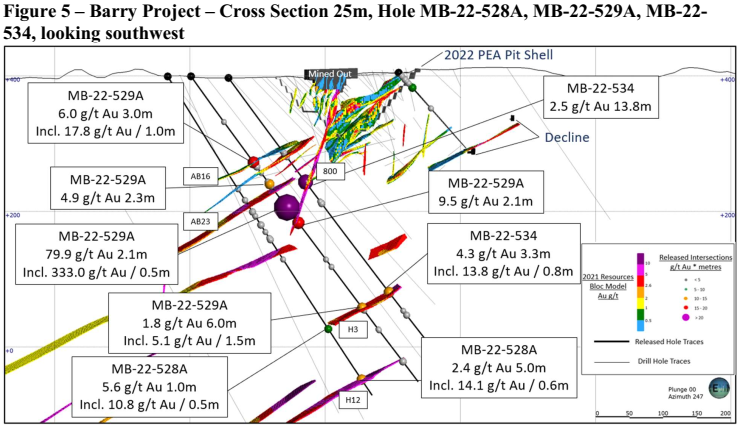

As winter conditions allow access to drill sites, the upcoming infill program will be focused on the prolific sub-vertical 800 Zone and its surrounding H-series zones. Preliminary results from accessible drill site returned good results in accordance with 2021 MRE block model prediction. Highlights include 2.5 g/t Au over 13.8 m including 5.3 g/t Au over 2.9 m in hole MB-22-534, and 9.5 g/t Au over 2.1 m in hole MB-22-529A. In addition to these results the highest drill hole sample ever reported at the Barry project has returned 333.0 g/t Au over 0.5 m included in a mineralized interval of 79.9 g/t Au over 2.1 m in hole MB-22-529A from a newly interpreted H series zone nearby the 800 zone (figure 5).

Barry Deposit Geology

The Barry gold deposit is characterized by three dominant sets of structures, all dipping to the southeast. The sub-vertical shear zones and the H-Series shear zones dipping 25 to 40 degrees are hosted within intermediate to mafic volcanics and tuffs with local felsic intrusions. Contact zones dip at 50-65 degrees along the lower and upper contacts of the D1, D2 and D3 felsic intrusions with mafic volcanics. Gold mineralization is associated with disseminated sulfides within shear zones and veins with local visible gold. The Barry deposit has been delineated over 1.4 kilometre along strike and 700 m vertical and remains open for expansion.

Corporate Updates

The Company is also pleased to announce that it has retained PI Financial Corp. (“PI”) to provide marketing services in accordance with TSX Venture Exchange (“TSX”) policies. PI will trade the securities of Bonterra on the TSX for the purposes of maintaining an orderly market. In consideration of the services provided by PI, the Company will pay PI a monthly cash fee of $5,000 for a minimum term of three months and renewable thereafter. Bonterra and PI are unrelated and unaffiliated entities. PI will not receive shares or options as compensation. The capital used for market making will be provided by PI.

In addition, the Company also announces that at the annual and special meeting of its shareholders held on June 22, 2022 (the “Meeting”), the shareholders approved the adoption of Bonterra’s new omnibus equity incentive plan (the “Omnibus Plan”) and reserved common shares of Bonterra (“Common Shares”) for issuance under the Omnibus Plan. The Omnibus Plan allows the Company to issue stock options, restricted share units, performance share units and deferred share nits (the “Awards”). The Omnibus Plan is a “rolling up to 10% plan” (as that term is used by the TSX) and replaces the Company’s previous rolling 10% stock option plan. The maximum aggregate number of Common Shares that may be reserved for issuance under the Omnibus Plan at any point in time is 10% of the outstanding Common Shares in the capital of the Company at the time of the grant of an Award and the Common Shares reserved and currently available for issuance under the Omnibus Plan is 12,619,550 Common Shares (such number being equal to approximately 10% of the issued and outstanding Common Shares). On November 24, 2021, the TSX adopted a new policy governing security-based compensation (the “New Policy 4.4”). In accordance with the New Policy 4.4, the Company has adopted a number of these amendments in the Omnibus Plan. These changes include allowing option holders to exercise options on a “cashless exercise” or “net exercise” basis, as now expressly permitted by the New Policy 4.4. “Cashless exercise” is a method of exercising stock options in which a securities dealer loans funds to the option holder or sells the same shares as those underlying the option, prior to or in conjunction with the exercise of options, to allow the option holder to fund the exercise of some or all of their options. “Net exercise” is a method of option exercise under which the option holder does not make any payment to the issuer for the exercise of their options and receives on exercise a number of shares equal to the intrinsic value (current market price less the exercise price) of the option valued at the current market price. Under the New Policy 4.4, the current market price must be the 5-day volume weighted average trading price prior to option exercise. “Net exercise” may not be utilized by persons performing investor relations services. The Omnibus Plan, is further described in the Company’s information circular, a copy of which can be found on the Company’s SEDAR profile at www.sedar.com.

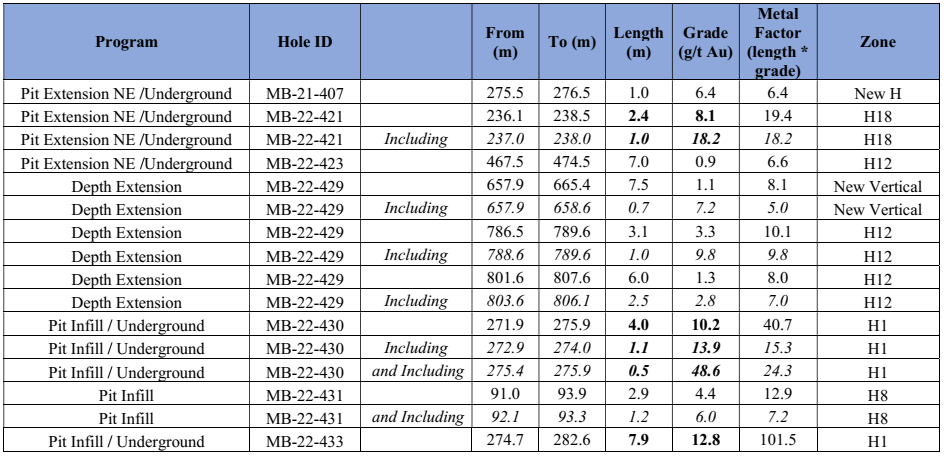

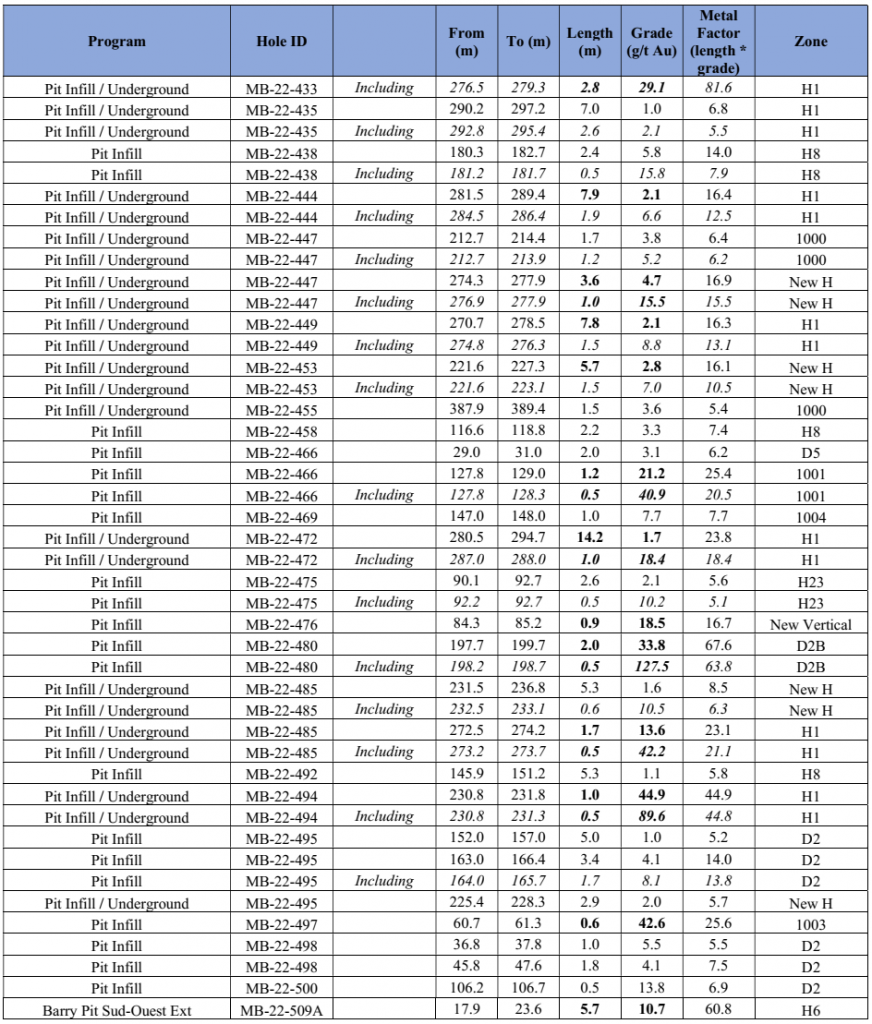

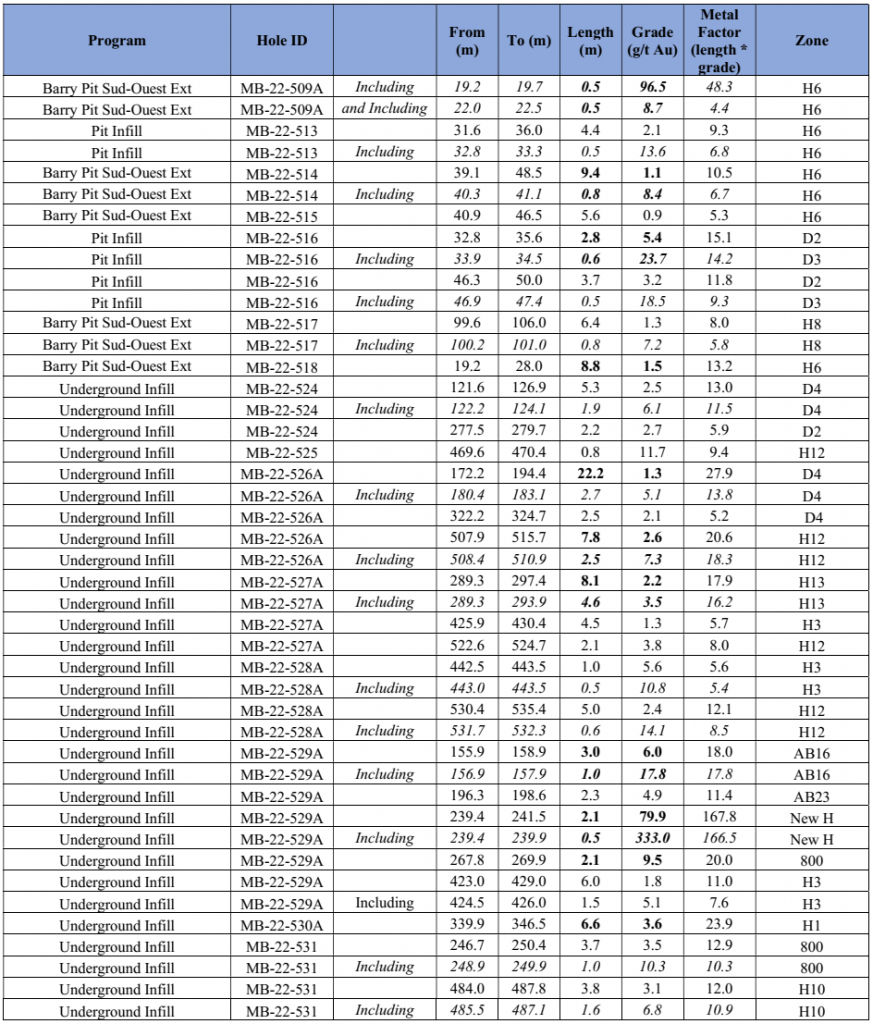

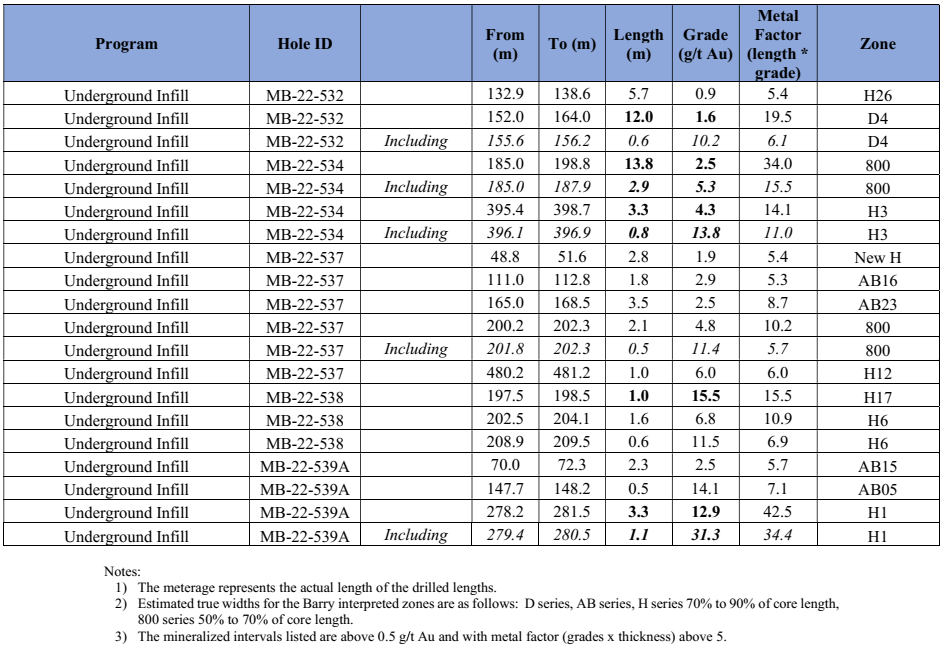

Diamond drill hole results table:

The following table shows the significant intersections of the drill holes presented in this press release.

Quality Control and Reporting Protocols

The Barry project’s drill core gold analyses are performed at the Company’s Bachelor Mine analytical laboratory (the “Laboratory”) And at AGAT Laboratories in Val d’or. The Company employs a rigorous QA-QC analysis program that meets industry standards. The analyses are carried out by fire assay (A.A.) with atomic absorption finish at Bachelor Mine Laboratory and with gravimetric finish for assay above 10g/t Au at AGAT laboratories. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor the Laboratory’s performance. The Company’s QA-QC program requires that at least 10% of samples be analyzed by an independent laboratory. These verification samples are sent to ALS Minerals laboratory facility located in Val-d’Or, Quebec. The verifications show a high degree of correlation with the Laboratory’s results.

Qualified Persons

Donald Trudel, P.Geo., (OGQ # 813) Director of Geology of the Company oversees all exploration activities on the Barry property and has compiled and approved the information contained in this press release. Mr. Trudel is a qualified person as defined by National Instrument 43-101 on standards of disclosure for mineral projects.

About Bonterra Resources Inc.

Bonterra is a Canadian gold exploration company with a large portfolio of advanced exploration assets anchored by a central milling facility in Quebec, Canada. The Company has four main assets, Gladiator, Barry, Moroy, and Bachelor that collectively have a total of 1.24 million ounces in Measured and Indicated categories, and 1.78 million ounces in Inferred category. Importantly, the Company owns the only permitted and operational gold mill in the region. Bonterra is focused on graduating from advanced exploration to a development company to deliver shareholder value.

FOR ADDITIONAL INFORMATION

Marc-André Pelletier, President & CEO

ir@btrgold.com

2872 Sullivan Road, Suite 2, Val d’Or, Quebec J9P 0B9

819-279-9304 | Website: www.btrgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This press release contains “forward-looking information” that is based on Bonterra’s current expectations, estimates, forecasts and projections. This forward-looking information includes, among other things, statements with respect to Bonterra’s exploration and development plans and placing the Bachelor-Moroy deposit under long-term care and maintenance. The words “will”, “anticipated”, “plans” or other similar words and phrases are intended to identify forward-looking information. This forward-looking information includes namely information with respect to the planned exploration programs and the potential growth in mineral resources. Exploration results that include drill results on wide spacings may not be indicative of the occurrence of a mineral deposit and such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. The potential quantities and grades of drilling targets are conceptual in nature and, there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the targets being delineated as mineral resources. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause Bonterra’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forwardlooking information. Such factors include but are not limited to: uncertainties related exploration and development; the ability to raise sufficient capital to fund exploration and development; changes in economic conditions or financial markets, environmental and other judicial, regulatory, political and competitive developments; technological or operational difficulties or inability to obtain permits encountered in connection with exploration activities; and labour relations matters. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information.