Val-d’Or, QC – April 15, 2024 – Bonterra Resources Inc. (TSX-V: BTR, OTCQX: BONXF, FSE: 9BR2) (“Bonterra” or the “Company”) is pleased to announce encouraging drill results and an update on the ongoing drilling program on the Phoenix JV (formerly known as the UrbanBarry Property) (the “Project”). The Project is under a definitive earn-in and joint venture agreement (the “Agreement”) with Osisko Mining Inc. (“Osisko Mining”). Under the Agreement, Osisko Mining has the right to acquire up to a 70% interest in the Project by spending $30 million in work expenditures, with a minimum spending commitment of $10 million per year over a threeyear period (see press release dated November 28, 2023 for more details).

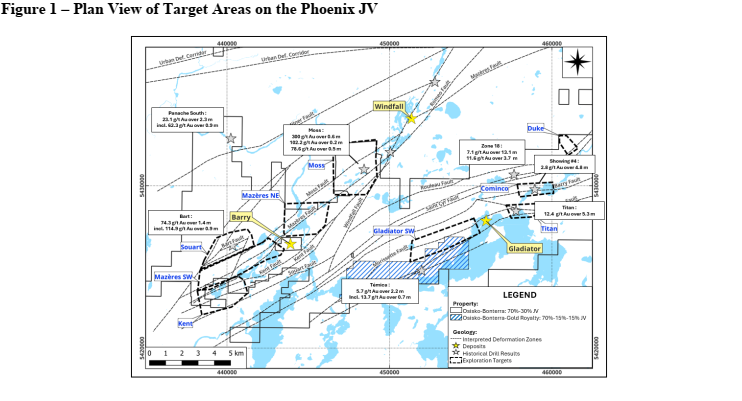

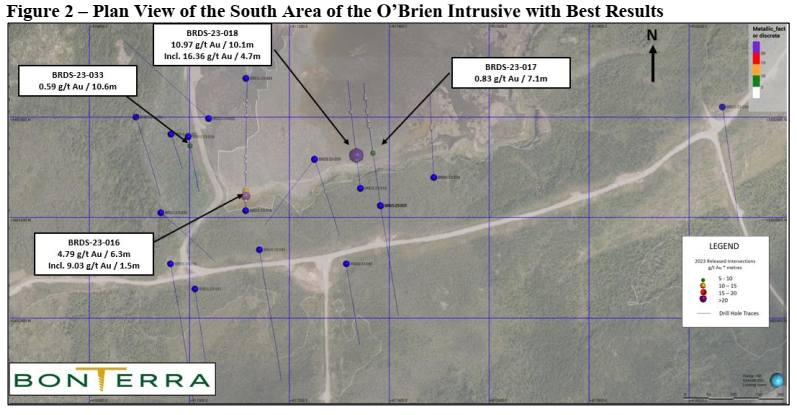

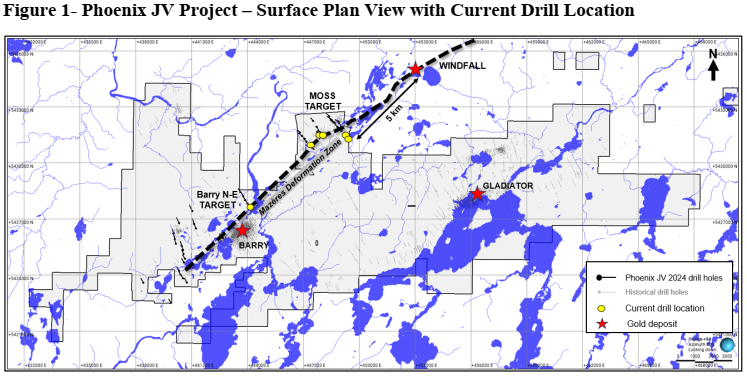

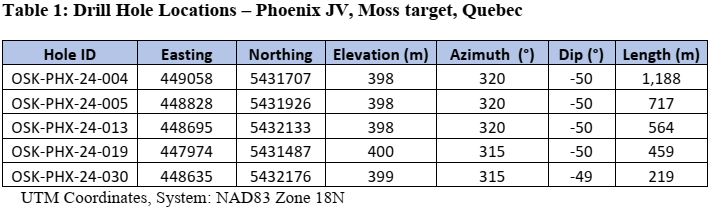

To date, approximately 20,000 meters (“m”) have been drilled on the Project and exploration efforts are on track to exceed the minimum spending commitment of $10 million per year outlined in the Agreement. There are currently five drill rigs on the Moss target, while one is dedicated to the Barry northeast target (see Figure 1).

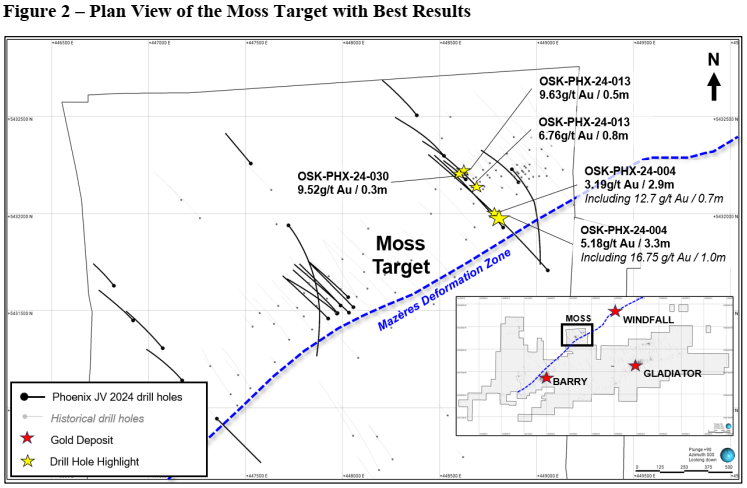

The first drill results at the Moss target, located five kilometers (“km”) southwest of the multimillion ounce Windfall Gold deposit, have confirmed similarities with the geological character of the high-grade Lynx Zone along the Mazères Fault that extends towards the Moss target.

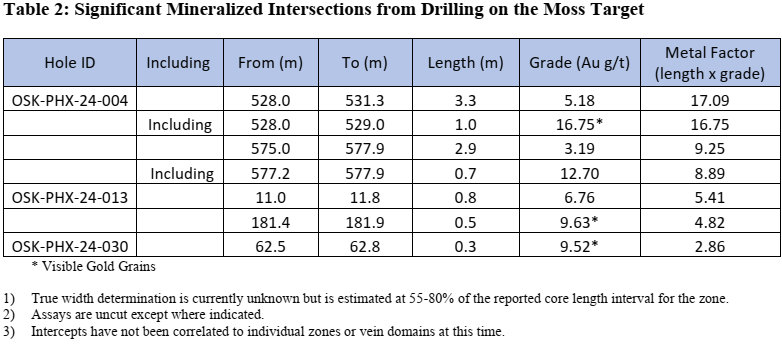

Highlights at Moss Target Include:

- 5.18 g/t Au over 3.3 m, including 16.75 g/t Au over 1.0 m and,3.19 g/t Au over 2.9 m, including 12.70 g/t Au over 0.7 m in hole OSK-PHX-24-04

- 6.76 g/t Au over 0.8 m and 9.63 g/t Au over 0.5 m in hole OSK-PHX-24-13

- 9.52 g/t Au over 0.3 m in hole OSK-PHX-24-030

Marc-André Pelletier, President and CEO commented: “Today’s results are very encouraging and demonstrate geological similarities to the Windfall gold deposit. Notably, most of the drill hole intercepts at Moss are within 400 m below surface, with additional drilling planned to confirm mineralization continuity at depth. Osisko Mining intends to mobilize one additional drill rig in the next few months, bringing the total to six operational rigs at the Moss target. Although it’s still early in the discovery process, we’re excited by the results thus far and impressed by Osisko Mining’s commitment to accelerating the development of the Urban-Barry mining camp, where nearly ten million ounces have already been identified to date.”

Highlights of the Diamond Drilling Program:

The drilling program at the Moss target includes several drill fences designed at defining the lithostructural context of the area, which according to current geological models, is similar to that encountered at the Lynx Zone within the Windfall gold deposit. Notably, this involves exploring the presence of altered felsic volcanic rocks, felsic porphyritic dikes, and high-grade gold mineralization associated with quartz veins within the footwall of the Mazères fault. Additionally, these drill fences seek to intersect potential new mineralized lenses situated between the Mazères fault and the Moss showing.

Quality Control and Reporting Protocols (adopted by Osisko Mining)

NQ core assays were obtained by either 1-kilogram screen fire assay or standard 50-gram fireassaying-AA finish or gravimetric finish at ALS Laboratories in Val-d’Or, Québec, or Vancouver, British Colombia. The 1-kilogram screen assay method is selected by the geologist when samples contain coarse gold or present a higher percentage of pyrite than surrounding intervals. All samples are also analyzed for multi-elements, including silver, using Four Acid Digestion-ICP-MS method at ALS Laboratories. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results is performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices. Standards and blanks are included with every 20 samples for QA/QC purposes by Osisko Mining as well as the lab.

Qualified Person

M. Donald Trudel, P.Geo. (OGQ # 813), Director Geology for the Company, has reviewed and approved the technical information contained in this press release. Mr. Trudel is a qualified person as defined by National Instrument 43-101 on standards of disclosure for mineral projects.

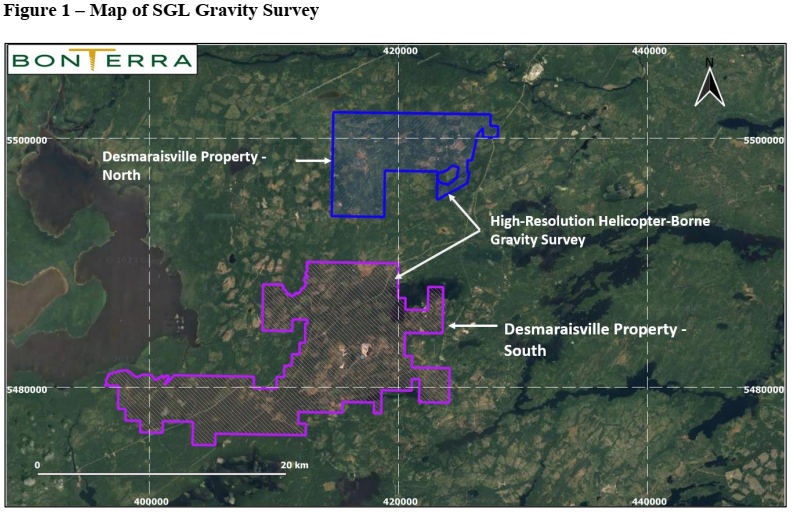

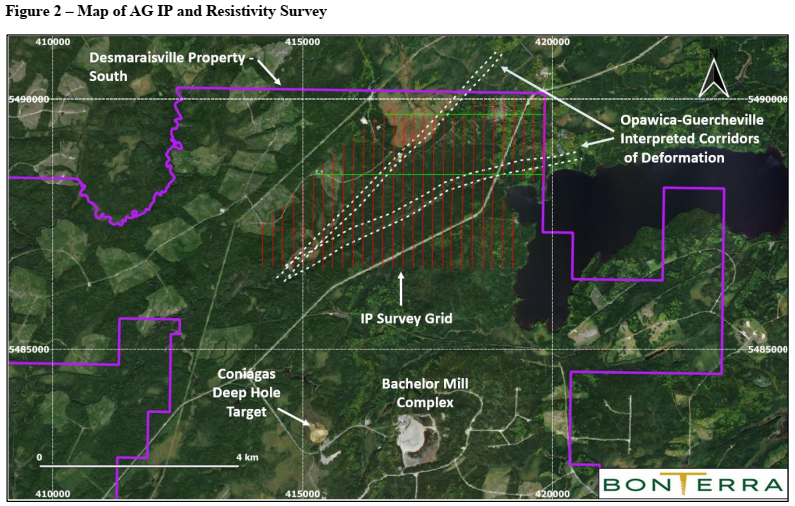

About Bonterra Resources Inc.

Bonterra is a Canadian gold exploration company with a portfolio of advanced exploration assets anchored by a central milling facility in Quebec, Canada. The Company’s assets include the Gladiator, Barry, Moroy, and Bachelor gold deposits, which collectively hold 1.24 million ounces in Measured and Indicated categories and 1.78 million ounces in the Inferred category.

In November 2023, the Company entered into a earn-in and joint venture agreement with Osisko Mining Inc. for the Urban-Barry properties, which include the Gladiator and Barry deposits. Over the next three years, Osisko can earn a 70% interest by incurring $30 million in work expenditures. This strategic transaction highlights Bonterra’s dedication to advancing its exploration assets, marking a significant step towards development.

FOR ADDITIONAL INFORMATION

Marc-André Pelletier, President & CEO

ir@btrgold.com

2872 Sullivan Road, Suite 2, Val d’Or, Quebec J9P 0B9

819-279-9304 | Website: www.btrgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution regarding forward-looking statements

This press release contains “forward-looking information” that is based on Bonterra’s current expectations, estimates, forecasts, and projections. This forward-looking information includes, among other things, statements with respect to the earn-in and joint venture agreement with Osisko Mining announced on November 28, 2023. The words “will”, “anticipated”, “plans” or other similar words and phrases are intended to identify forward-looking information. This forward-looking information includes namely information with respect to the planned exploration programs and the potential growth in mineral resources. Exploration results that include drill results on wide spacings may not be indicative of the occurrence of a mineral deposit and such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics, and economic potential to be classed as a category of mineral resource. The potential quantities and grades of drilling targets are conceptual in nature and, there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the targets being delineated as mineral resources. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause Bonterra’s actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include but are not limited to: uncertainties related exploration and development; the ability to raise sufficient capital to fund exploration and development; changes in economic conditions or financial markets, environmental and other judicial, regulatory, political, and competitive developments; technological or operational difficulties or inability to obtain permits encountered in connection with exploration activities; and labour relations matters. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information.